The preparation of the statement of cash flows, however, requires a lot of additional information. An adjusted trial balance is a listing of the ending balances in all accounts after adjusting entries have been prepared. While the definition of the document is relatively straightforward, you’re probably thinking – what is the purpose of the adjusted trial balance?

4 Use the Ledger Balances to Prepare an Adjusted Trial Balance

Since you’re making two entries, be sure to double-check the debits and credits don’t apply to the wrong account. This can result in a balance increasing when it should be decreasing leaving you with incorrect numbers at the end of an accounting period. Preparing an adjusted trial balance is the fifth step in the accounting cycle and is the last step before financial statements can be produced.

Best Business Bank Account for Sole Proprietor: Top Picks for 2025

Our team is ready to learn about your business and guide you to the right solution. The balance of Accounts Receivable is increased to $3,700, i.e. $3,400 unadjusted balance plus $300 adjustment. Service Revenue will now be $9,850 from the unadjusted balance of $9,550. Depreciation is a non-cash expense identified to account for the deterioration of fixed assets to reflect the reduction in useful economic life. Bench simplifies your small business accounting by combining intuitive software that automates the busywork with real, professional human support.

First method – inclusion of adjusting entries into ledger accounts:

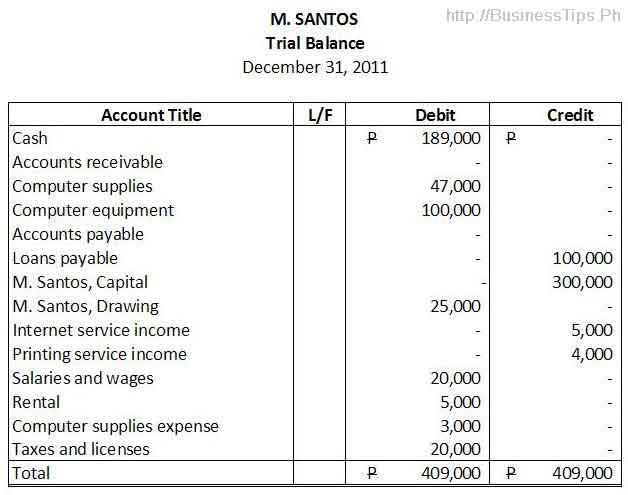

Its purpose is to test the equality between debits and credits after adjusting entries are made, i.e., after account balances have been updated. We are using the same posting accounts as we did for the unadjusted trial balance just adding on. Notice how we start with the unadjusted trial balance controllable costs and uncontrollable costs in each account and add any debits on the left and any credits on the right. This type of trial balance is issued by accounting software packages. An unadjusted trial balance is only used in double-entry bookkeeping, where there is a credit to every debit and all the entries are balanced.

If thereis a difference between the two numbers, that difference is theamount of net income, or net loss, the company has earned. The balance sheet is the third statement prepared after thestatement of retained earnings and lists what the organization owns(assets), what it owes(liabilities), and what theshareholders control (equity) on aspecific date. Remember that the balance sheet represents theaccounting equation, where assets equal liabilities plusstockholders’ equity. The trial balance information for Printing Plus is shown previously. If we go back and look at the trial balance for Printing Plus, we see that the trial balance shows debits and credits equal to $34,000. Looking at the asset section of the balance sheet, Accumulated Depreciation–Equipment is included as a contra asset account to equipment.

Unit 4: Completion of the Accounting Cycle

Each month, you prepare a trial balance showing your company’s position. After preparing your trial balance this month, you discover that it does not balance. The debit column shows $2,000 more dollars than the credit column. Ensuring the adjusted trial balance report is presented in a clear, organized way will make it easier for you when it comes to preparing your financial statements at the end of the year.

Looking at the asset section of the balance sheet, AccumulatedDepreciation–Equipment is included as a contra asset account toequipment. The accumulated depreciation ($75) is taken away fromthe original cost of the equipment ($3,500) to show the book valueof equipment ($3,425). The accounting equation is balanced, asshown on the balance sheet, because total assets equal $29,965 asdo the total liabilities and stockholders’ equity.

For Printing Plus, the following is its January 2019 Income Statement. As you have learned, the adjusted trial balance is an importantstep in the accounting process. But outside of the accountingdepartment, why is the adjusted trial balance important to the restof the organization? An employee or customer may not immediatelysee the impact of the adjusted trial balance on his or herinvolvement with the company. As you have learned, the adjusted trial balance is an important step in the accounting process.

The five column sets are the trial balance, adjustments, adjusted trial balance, income statement, and the balance sheet. After a company posts its day-to-day journal entries, it can begin transferring that information to the trial balance columns of the 10-column worksheet. To prepare the financial statements, a company will look at the adjusted trial balance for account information. From this information, the company will begin constructing each of the statements, beginning with the income statement. The statement of retained earnings will include beginning retained earnings, any net income (loss) (found on the income statement), and dividends. The balance sheet is going to include assets, contra assets, liabilities, and stockholder equity accounts, including ending retained earnings and common stock.

This trial balance is prepared after taking into account all the adjusting entries prepared in the previous step of the accounting cycle. Both the debit and credit columns are calculated at the bottom of a trial balance. As with the accounting equation, these debit and credit totals must always be equal. If they aren’t equal, the trial balance was prepared incorrectly or the journal entries weren’t transferred to the ledger accounts accurately. There are five sets of columns, each set having a column fordebit and credit, for a total of 10 columns.

- It is usually used by large companies where a lot of adjusting entries are prepared at the end of each accounting period.

- Preparing an adjusted trial balance is the sixth step in the accounting cycle.

- Each month, you prepare a trial balance showing your company’s position.

- Once we add the $4,665 to thecredit side of the balance sheet column, the two columns equal$30,140.

- Financial statements drawn on the basis of this version of trial balance generally comply with major accounting frameworks, like GAAP and IFRS.

There are many types of software to explore, which can be used to prepare an adjusted trial balance. You can produce it using ExCel, AccountEdge Pro, QuickBooks Desktop and Sage 50cloud, to name just a few common options. At the bottom of the table, the debit and credit columns are totaled. If the totals of the two columns do not match each other, it means that there is an error. Examples of such transactions are depreciation, closing stock, accruals, deposits, etc.