The best value of ROE is roughly several dozen percent, but such a level is difficult to reach and then maintain. The higher the ROE of a company, the firmer and more beneficial its situation on the market. Across the same time span, Company B’s ROE increased from 15.9% to 20.2%, despite the fact that the amount of net income generated was the same amount. The two companies have virtually identical financials, with the following shared operating values listed below. For example, say that two competing stores both earn $100 million in income over a period.

How to Calculate ROE

In this scenario, first a company would have to pay back its debts, or liabilities, and then the remainder of its assets would be spread among the shareholders. The ratio measures the relationship between a company’s net income and shareholder equity. It indicates how much return the shareholders have been getting on an investment for each dollar invested. If profits are increasing, then shareholders should receive more from this investment. The balance between equity financing and debt in a company’s capital structure also dictates ROE. Equity financing increases the shareholder’s equity base, which can dilute the ROE since the same amount of profits is spread over a larger amount of equity.

- Low ROCE may result in a lack of investor confidence and reduced valuation of the company.

- If the firm’s ROE is steadily increasing in a sustainable manner—increases are not sudden or really huge—you might conclude that management is doing a good job.

- ROE is very useful for comparing the performance of similar companies in the same industry and can show you which are making most efficient use of their (and by extension their investors’) money.

- However, investors should consider the sustainability of this high ROCE and the impact of industry and economic factors on future performance.

Why You Can Trust Finance Strategists

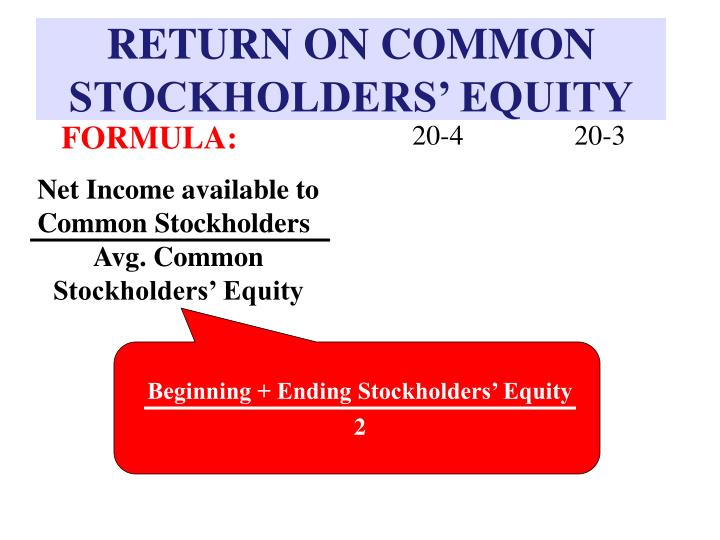

Unlike other return on investment ratios, ROE is a profitability ratio from the investor’s point of view—not the company. In other words, this ratio calculates how much money is made based on the investors’ investment in the company, not the company’s investment in assets or something else. Return on Common Equity (ROE) measures how efficiently a company uses the money invested by its common shareholders to generate profits.

A Practical Investors Guide to Return on Common Equity (ROE)

The shareholder equity amount used in the formula is usually averaged for the period being evaluated. A company with a lower ROE but a solid balance sheet and steady growth potential may be a better investment than one with a higher ROE that has a high level of debt. It’s also essential to consider industry trends and market conditions to make informed investment decisions that align with your financial goals. A 2% ROE is generally considered low and may indicate that the company is not effectively using shareholders’ equity to generate profits.

Return on equity vs. return on capital employed

Calculating this ratio helps investors understand the performance of their shares and assists in making informed comparisons between companies across industries. A high ROCE signifies superior utilization of common equity, but this figure should be interpreted against industry averages and historical performance. Though the long-term ROE for the top ten S&P 500 companies has averaged around 18.6%, specific industries can be significantly higher or lower.

What does ROE stand for?

Before embarking on calculating ROCE, familiarizing yourself with a few key concepts is crucial. Net Income is the profit a company earns after all its costs, expenses, tax office and and taxes have been subtracted from total revenue. Now, assume that LossCo has had a windfall in the most recent year and has returned to profitability.

ROE is closely related to measures like return on assets (ROA) and return on investment (ROI). In this case, the net profit before the deduction of dividends on preferred shares is used as the numerator in the formula, while the total of ordinary equity and preferred equity is used as the denominator. The equity of a company consists of paid-up ordinary share capital, reserves, and unappropriated profit.

The return on equity ratio formula is calculated by dividing net income by shareholder’s equity. Return on equity is often used in conjunction with return on assets, a measure of a company’s net profit divided by its total assets. If this sounds similar to ROE, it’s because the formulas are almost identical—except for the fact that ROE considers debt when assessing how well a company generates profits.