The accounting rate of return is a capital budgeting metric to calculate an investment’s profitability. Businesses use ARR to compare multiple projects to determine each endeavor’s expected rate of return or to help decide on an investment or an acquisition. Accounting rate of return (also known as simple rate of return) is the ratio of estimated accounting profit of a project to the average investment made in the project. The internal rate of return (IRR) also measures the performance of investments or projects, but while ROR shows the total growth since the start of the project, IRR shows the annual growth rate.

Benefits of using the ARR calculator

Note that actual returns vary widely from year to year, and from stock to stock. If you’re making long-term investments, it’s important that you have a healthy cash flow to deal with any unforeseen events. Find out how GoCardless can help you with ad hoc payments or recurring payments. The accounting rate of return percentage needs to be compared to a target set by the organisation. If the accounting rate of return is greater than the target, then accept the project, if it is less then reject the project.

Accounting Calculators

If you choose to complete manual calculations to calculate the ARR it is important to pay attention to detail and keep your calculations accurate. If your manual calculations go even the slightest bit wrong, your ARR calculation will be wrong and you may decide about an investment or loan based on the wrong information. Hence using a calculator helps you omit the possibility of error to almost zero and enable you to do quick and easy calculations. Using the ARR calculator can also help to validate your manual account calculations. Depreciation is a direct cost that reduces the value of an asset or profit of a company. As such, it will reduce the return on an investment or project like any other cost.

How confident are you in your long term financial plan?

- One thing to watch out for here is that it is easy to presume you subtract the residual value from the initial investment.

- Accounting Rate of Return is calculated by taking the beginning book value and ending book value and dividing it by the beginning book value.

- The Accounting Rate of Return (ARR) Calculator uses several accounting formulas to provide visability of how each financial figure is calculated.

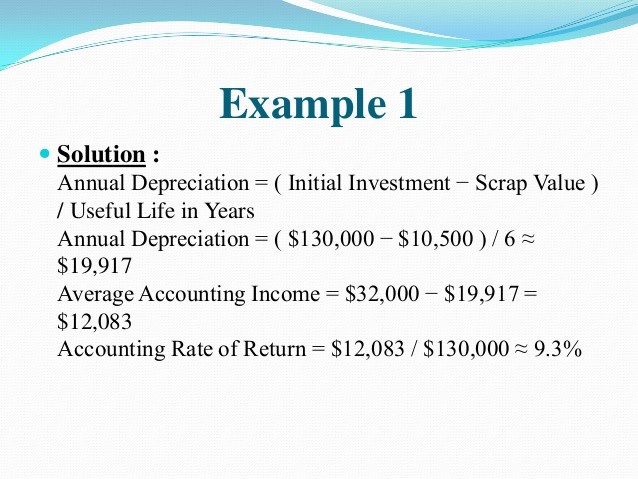

The accounting rate of return is a capital budgeting indicator that may be used to swiftly and easily determine the profitability of a project. Businesses generally utilize ARR to compare several projects and ascertain the expected rate of return for each one. The Accounting Rate of Return formula is straight-forward, making it easily accessible for all finance professionals. It is computed simply by dividing the average annual profit gained from an investment by the initial cost of the investment and expressing the result in percentage. The ARR is the annual percentage return from an investment based on its initial outlay.

Decision Rule

The next step in understanding RoR over time is to account for the time value of money (TVM), which the CAGR ignores. Discounted cash flows take the earnings of an investment and discount each of the cash flows based on a discount rate. The discount rate represents a minimum rate of return acceptable to the investor, or an assumed rate of inflation. In addition to investors, businesses use discounted cash flows to assess the profitability of their investments. The accounting rate of return (ARR) is a simple formula that allows investors and managers to determine the profitability of an asset or project. Because of its ease of use and determination of profitability, it is a handy tool to compare the profitability of various projects.

Depreciation method

The main difference between ARR and IRR is that IRR is a discounted cash flow formula while ARR is a non-discounted cash flow formula. ARR does not include the present value of future cash flows generated by a project. In this regard, ARR does not include the time value of money, where the value of a dollar is worth more today than tomorrow.

A company is considering in investing a project which requires an initial investment in a machine of $40,000. Net cash inflows of $15,000 will be generated for each of the first two years, $5,000 in each of years three and four and $35,000 in year five, after which time the machine will be sold for $5,000. The Accounting rate of return is used by businesses are you delivering potentially shippable product each sprint to measure the return on a project in terms of income, where income is not equivalent to cash flow because of other factors used in the computation of cash flow. Calculating ARR or Accounting Rate of Return provides visibility of the interest you have actually earned on your investment; the higher the ARR the higher the profitability of a project.

Of course, that doesn’t mean too much on its own, so here’s how to put that into practice and actually work out the profitability of your investments. For a project to have a good ARR, then it must be greater than or equal to the required rate of return. Candidates should note that accounting rate of return can not only be examined within the FFM syllabus, but also the F9 syllabus. Recent FFM exam sittings have shown that candidates are struggling with the concept of the accounting rate of return and this article aims to help candidates with this topic.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. AMC Company has been known for its well-known reputation of earning higher profits, but due to the recent recession, it has been hit, and the gains have started declining. ARR can be problematic in that it is subject to accounting policies which will vary from one organization to another and can be subject to manipulation.

The Compound Annual Growth Rate (CAGR) is another metric that shows the annual growth rate of an investment, but this time taking into account the effect of compound interest. A closely related concept to the simple rate of return is the compound annual growth rate (CAGR). The CAGR is the mean annual rate of return of an investment over a specified period of time longer than one year, which means the calculation must factor in growth over multiple periods. To find this, the profit for the whole project needs to be calculated, which is then divided by the number of years for which the project is running (in this case five years). As we can see from this, the accounting rate of return, unlike investment appraisal methods such as net present value, considers profits, not cash flows.

ICalculator helps you make an informed financial decision with the ARR online calculator. You just have to enter details as defined below into the calculator to get the ARR on any particular project running in your company. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.